Backward Linkages of Bangladeshi Textile and apparel industry: The export revenue of RMG sector in Bangladesh is $8421.52 million in 2022. But unfortunately, 60-70% of the total earnings is spent on buying raw materials. This study finds the challenges & limitations of backward linkage of RMG sector. In Bangladesh, cotton, yarn, fabric, dyes & chemicals, trims & accessories etc are must needed materials for backward linkage industry of RMG sector. For the pathetic condition of this sector, one of the major reasons is that cotton production is very low in this country due to unavailability of suitable soil & environment. Also, unavailability of commercially produced species of cotton. There is no genetic engineered species of cotton plant. Another major reason is that trims and accessories production is also low due to lack of research and poor quality. Also, another major reason is that synthetic fiber production is also low due to lack of machines and lack of innovation and technology.

Therefore, this industry needs a sufficient internal supply of its raw materials to achieve robust growth. The backward linkage sector can complete the task. This was and continues to be Bangladesh’s major obstacle in this industry. Weak industrial exposure in our economy prevented the RMG sector from receiving enough support from the upstream sector. Most of the time, we must rely on outside sources, or import, for our basic resources. In these situations, even though this sector contributed significantly to our export profits, the economy’s value addition was inadequate. The majority of the profits were returned to over the limit, and on top of that, we are losing faith in our ability to produce in terms of timely shipment, price, etc. Therefore, in order for the RMG sector to continue growing at its current rate and for our export revenues to improve through value addition, there needs to be a strong establishment of backward linking industries. This paper aims to comprehend the RMG sector’s trends, how backward linkage might improve RMG performance, and lastly, how to establish backward linkage industries in Bangladesh.

Introduction

In our nation, it’s usual to have ineffective management practices while managing raw materials. Issues with production delays result from it. Due of the delayed production and subsequent delayed shipments, the entire industry is harmed by this. The digitalization of the data and communication system is not known to the relevant executives. Since they are at ease with manual information flow systems, there is a reduction in the effectiveness of raw material management, which leads to low production. On the factory floor, the issues are visible to the naked eye. However, the problem’s notification falls mostly on inventory management[1]. Bangladesh’s economy greatly benefits from the ready-made clothing industry.

RMG accounts for around 14.07 percent of Bangladesh’s GDP and 81 percent of all export revenues when looking at fundamental economic factors. The second-largest exporter of RMGs worldwide is Bangladesh. Bangladesh generated USD 8421.52 million in RMG export revenue in 2022, making up 90.68 percent of all RMG exports[2]. Backward linkage, in general, refers to the usage of manufactured inputs from one company or industry by another.

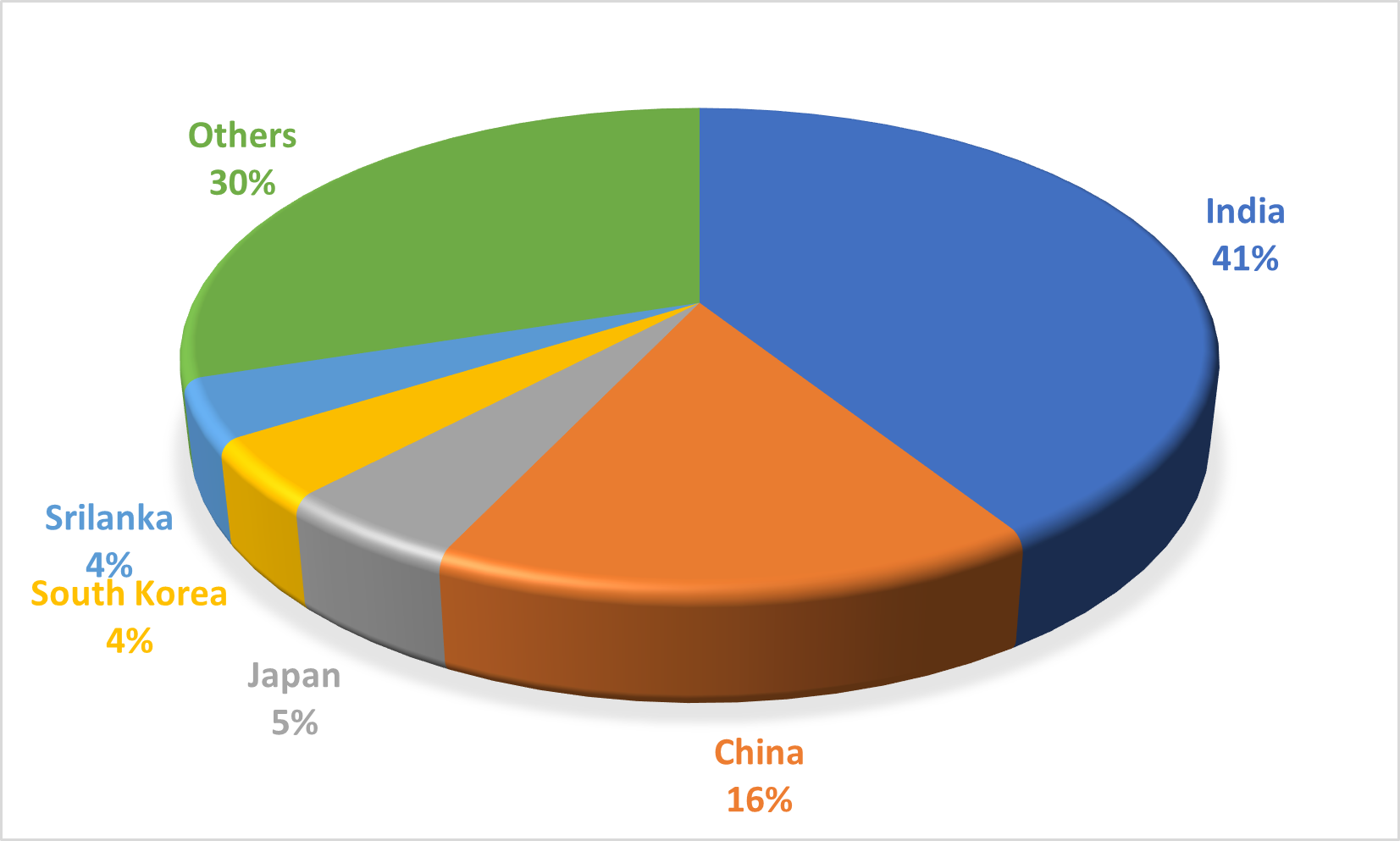

Thus, three stages are necessary to produce completed textiles in the textile business. The first stage involves turning cotton or fibers into yarns, the second stage involves turning skeins into grey fabrics, and the third stage involves turning grey fabrics into colored, printed, or other completed fabrics or clothes. Backward linkage., a subset of Bangladesh’s textile industry includes cotton, yarn, fabric, dyes and chemicals, trims and accessories etc[3]. The Bangladeshi textile industry’s RMG sector has a 5-8% backward tie to overall demand. Because of this, raw materials like fabric, trimmings, and accessories are imported from nations with fiercer competition. As a result, a sizable portion of raw materials are being imported.

60–70% of the cost of the finished product must be paid for by purchasing the raw materials, and the profit from these production orders is quite small. It takes a long time to import raw materials from other nations[4]. For instance, Bangladesh imported for its domestic apparel sector $1.32 billion in knitted fabrics, $2.76 billion in woven fabrics, and $0.10 billion in yarn in 2020. It takes around 20 days to receive the raw materials if local garment exporters import yarn and textiles from other nations like China and India[5].

According to figures from the Bangladesh Textile Mills Association (BTMA), yarn purchases in Bangladesh by textile millers in the months of January through June were US$2.66 billion, or 76% of the total import value of US$3.5 billion the year prior. Additionally, imports of woven fabrics totaled US $2.21 billion in the first half of this year, which is almost 70% of what was purchased in 2021. Meanwhile, the country’s knitters are said to have purchased fabrics worth US $1.29 billion from foreign suppliers in the first half of 2022, which is more than three-fifths of the US $2 billion spent on textiles in 2021[6].

Objectives

The main objective of this research is to investigate the challenges and limitations of backward linkage of RMG sector in Bangladesh and analysis the contributing factors. Some more specific objectives are given below:

- Determine the root causes of each challenge in backward linkage of RMG sector.

- Determine the root causes of the limitations we have in backward linkage of RMG sector.

- Determine the overall scenario of backward linkage of RMG sector

- Determine the reason for slow growth of backward linkage industries in Bangladesh.

- Determine the procurement practices of industries in Bangladesh.

- Determine the pathway of solutions to accelerate in growth in backward linkage industries in Bangladesh.

- Determine the future opportunities of backward linkage in Bangladesh.

Steps from fiber/cotton to finished fabric

Fiber/cotton ➜ Yarns ➜ Grey fabrics ➜ Finished fabrics ➜ Spinning ➜ Weaving/Knitting ➜ Dyeing, Printing, Finishing

Background

Backward linkage is the process by which one company or industry uses inputs produced by another company or industry[7]. Bangladesh is only capable of knitting and finishing in the knitwear industries, and it lags behind in producing yarn and textiles, which are crucial components for the woven industry. Only accessories saw success because they were able to meet 80% of domestic demand. How well RMG sector links can operate both backward and forward is a key factor in the success of the apparel industry. The production flow is likely to be disrupted if the manufacturer has effective control over the supply of the raw materials, components, and support services required to make the finished product.

After the removal of quotas in 2005, Bangladesh’s RMG industry now faces intense competition in the international market for garment exports. This industry also faces a number of difficulties, including unskilled labor, inadequate infrastructure, an electricity crisis, a gas shortage, insufficient bank loans with high interest rates, high tax rates, complex social compliance requirements, political unrest, lack of new investment, weak backward and forward linkages, etc. To overcome these obstacles, a number of cooperative and coordinated actions by owners and significant stakeholders must be made in order to achieve the ultimate aim of taking the top spot in the global garment market[8].

In addition, there has been a rise in rivalry from nearby nations including Thailand, India, Pakistan, China, and Bangladesh, from which Bangladesh imports fabrics to satisfy the fabric needs of its RMG sector. Due to their internal utilization of domestically produced yarns and fabrics, these nations have stronger backward linkage support, which puts pressure on Bangladesh’s garment industries by driving export prices up[9].

With a goal of increasing cotton production, Bangladesh Cotton Development Board (BCDB) has set a production range of 176286 bales in 2020-21[10]. The primary material used to create yarn and fabric is cotton. But a large amount of land is needed to grow cotton. However, Bangladesh is a small nation with limited land area. Additionally, Bangladesh lacks the specific type of soil needed to grow good cotton. Cotton growing is less profitable in Bangladesh, according to the farmers. They then switch to other fibers as a result. Bangladesh is therefore forced to rely on other nations for its cotton needs, including Uzbekistan, India, China, Pakistan, the United States, Egypt, Turkey, and Australia[2].

Spinning mills are the facilities where the yarn is made from the fiber. It is a crucial area of the textile industry because it is here that yarn for knitting, weaving, and sewing is made. Cotton yarn makes up the majority of the primary spinning products. About 60% of the cost of items supplied goes toward managing and focusing raw materials, which is still not being done. The productivity of our mills is another factor that is still at least 10% lower than that of other nations like China, Vietnam, India, and Pakistan.

Raw materials and productivity by themselves can demonstrate the way to increase the spinning industry’s margin. Weaving is the name given to the process of creating woven fabric. Bangladesh’s woven fabric manufacturing environment is not ideal. Because weaving is so expensive in the textile sector. A woven composite factory will cost at least $35 million to establish. A significant amount of cloth is imported from China, Vietnam, and other nations in order to operate this industry and satisfy customer demand. The textile industry must initially locate a trustworthy source to import the fabric and yarn. The entire cost of an order, which includes the cost of importing woven fabrics, is 75%. This costs Bangladesh a great deal of money[2].

Knitting is the interloping of yarn technique used to create knit fabrics. The textile industry’s largest market contribution in Bangladesh is the knitting sector. The availability of upgrades and inexpensive machine knitting have caused this business to grow significantly. In Bangladesh, there have been numerous composite knit clothing companies during the past ten years. The knitwear sector in Bangladesh offers a wide range of items with a high level of added value, which are in high demand in western nations. As the textile industry expanded quickly, there was a huge increase in the need for raw materials[8].

The trim and accessory industries in Bangladesh are well advanced. It fully maintains demand and offers value-added services and goods. Bangladesh produces trims and accessories of extremely high quality. Since the textile industry has expanded, the trims and accessories market has become more than sufficient. More than 1400 trims and accessory businesses operate in Bangladesh today, rising to the challenges posed by the worldwide market and offering the highest quality complete goods[1]. The textile and apparel industries are currently facing a crisis. It is necessary to eliminate all potential causes of low output. To satisfy the demands of a competitive market, adequate transformation is required. The entire planet is undergoing a change in strategy.

Literature Review

Condition of overall backward linkage of RMG sector

The study couldn’t find any specific papers about challenges & limitation of backward linkage of RMG industry of Bangladesh. A journal about the overall backward linkage in readymade garment industry in Bangladesh of RMG by Mohammad Rakib Ibn Habib says that, It is inevitable that one of the major issues of success in readymade garment (RMG) industry in Bangladesh must depend on backward linkage conditions, support, and strategy formulation[7]. According to data from Bangladesh Textile Mills Association (BTMA), textile millers in Bangladesh purchased yarn worth US $ 2.66 billion in January-June, accounting for 76% of the total import value of US $ 3.5 billion in the previous year, added imports of yarn, cotton, knitted and woven fabrics skyrocketed to the point where their combined value in the January-June 2022 period almost equaled that of the entire previous year.

Condition of cotton fiber production

Only 1.77 lakh cotton bales were produced in the nation in 2021, which was insufficient to supply even one spinning mill with all of its needs. Over the last five years, production has climbed by 10,000 bales annually, but the output has not reached 2 lakh bales[11]. Long-term crops require 6-7 months to produce. In Bangladesh, the commercial types CB-1, CB-3, CB-5, CB-9, and CB-10 are grown. Only two of the five types—CB-5 and CB-9—are hairy varieties, and all five are long-lasting and require at least six months. They are only mildly tolerant to sucking pests.

In many cotton-growing regions, farmers now find it more economical to plant other crops like rice, maize, vegetables, bananas, flowers, and tobacco than cotton because cotton is currently in such intense competition with other crops. Due to the extensive and indiscriminate use of pesticides, particularly insecticides for aphids, jassids, and cotton bollworms, cotton in Bangladesh is a significant polluter crop, like in many other nations. More than 15-20 insecticide sprays are applied each season, pushing insecticide expenditures to more than 40% of total input costs and causing pest resurgence and secondary outbreaks[12].

Condition of man-made fiber production

Every day, over 430 spinning mills are in operation. Only 27 of the 430 factories produce man-made fiber (MMF), but these are for a specific type of polyester yarn.[5]. According to figures from the Bangladesh Textile Mills Association, Bangladesh imported 78,208 tons of polyester staple fiber in 2016, an increase of 11.39 percent from 70,209 tons in 2015 and 35.72 percent from 51,729 tons in 2014. (BTMA). Viscose staple fiber imports were estimated at 29,146 tons in 2016, a small decrease from 29,538 tons in 2015. The statistics revealed a volume of 16,063 tons from January to June of 2017. Viscose staple fiber imports were 18,115 tons in 2014 for Bangladesh.

Tencel, a fiber derived from trees and leaves, was imported in quantities of 5,034 tons in 2016 and 6,199 tons in 2015. There are now more factories making synthetic fibers. From 10 to 12 production units for polyester fibers alone seven years ago, there are now 52. There are ten Tencel plants and 45 viscose staple fiber mills. Despite the fact that cotton fiber continues to be the primary material used by spinners, the proportion of man-made fiber has increased globally. When compared to even five years ago, the ratio of yarn created from cotton to artificial yarn increased to around 80:20, whereas it was 90:10 even five years ago[13].

Condition of fabric production

The Bangladesh Textile Mills Association (BTMA) reports that entrepreneurs invested Tk 5,970 crore in 26 new manufacturing facilities, increasing their total capacity by more than 745,400 new spindles. For the domestic apparel market, Bangladesh imported woven fabrics worth $2.76 billion, knitted fabrics worth $1.32 billion, and yarn around $0.10 billion in 2020. Additionally, imports of woven fabrics totaled US $ 2.21 billion in the first half of this year, which is almost 70% of what was purchased in 2021. Meanwhile, the country’s knitters are said to have purchased fabrics worth US $ 1.29 billion from foreign suppliers in the first half of 2022, which is more than three-fifths of the US $ 2 billion spent on textiles in 2021[6].

Due to the expansion of backward links in the knit sub-sector, including their own knitting and dyeing section, which gives them an advantage to deliver shipments on time, the number of knitwear growth increased by 15.14 to 29.14 percent, while the growth of the woven sector decreased by 84.86% to 70.84%. Whereas the woven sector suffers from a lack of backward connectivity. 75% of the total sum was used to buy raw materials from overseas markets, resulting in a very low gross profit. The percentage of back-to-back L/C shares declined from 63.01% in 1992 to 45.10% in 2001, demonstrating the increase of backward linkage in the late 1990s. Only the knitting industry saw significant growth in this expansion since setting up a woven composite factory would cost around $35 million and developing a knit composite factory would cost about $3.5 million[14].

Condition of Trims and accessories production

Today Bangladesh has 1327 trims and accessories industry in Bangladesh meeting the challenges provided by the global market and providing the best quality full products[15]. There are over 1,800 factories in the nation making packaging and clothing accessories. They provide 40 different product categories, including buttons, plastic hangers, and polybags etc. In FY20 and FY19, the total revenue from garment exports was $33 billion and $40 billion, respectively. 95% of the demand for packaging and garment accessories in the RMG industry, which generates 86% of the nation’s export revenue, is satisfied locally. The accessories and packaging makers’ organization estimates that if the backward linkage industry operates at full capacity, it can supply 10% more[16].

Used tools and software

To display the findings, the team has investigated several applications and technologies. To identify the root causes and subsequent impacts of the main difficulties with backward linking, a fishbone diagram is employed[17]. The frequencies, percentages, and standard deviations of the replies to the questionnaire are represented using SPSS statistics analysis[18].

Findings & Analysis

The analysis is conducted based on the data the study collected through google form questionnaire. Primarily, the basic data that the study collected are analysed & portrayed here using bar chart. 56 different organization from all around the country & 70 different responsible executive from those organization participated in this process. By studying literature & interviewing responsible industry personnel & industry expert the study made hypothesis of problem statement. After that the study collected actual data from the industry to find out real time scenario of challenges & limitation of backward linkage. This analysis will portray an overview of causes, challenges, limitations & development opportunities of backward linkage of RMG sector in Bangladesh.

Basic status quo analysis of the industry

| Backward linkage industry | Status example |

|---|---|

| Typical certifications that buyers ask for raw materials | GOTS, BCI, LEED, OCR, Oeko-tex, GRS, Woolmark, etc. |

| Top local companies for supplying cotton | Sunny Cotton, PGS, Tradecom, Zaber spinning mill, Masco, Ha-Meem, SQ, Square etc. |

| Top foreign companies for supplying cotton | Bros, Allenberg, Cargil, Noble group, Shonxing, etc. |

| Top local companies for supplying trims | Rpac, Babylon, ABS trims, Blue Planet, COTS, UNION accessories, Montrims, smart narrows etc. |

| Top foreign companies for supplying trims | Avery dennison, Checkpoint, Annie aviation etc. |

| Top local companies for supplying accessories | Rpac SML, Agami Accessories Ltd, Epyllion, Blue planet, Union, Montrims, Smart Narrows etc. |

| Top foreign companies for supplying accessories | Avery dennison, Checkpoint, Pexar etc. |

Typically bought raw material

The study has identified some of the most bought raw materials required in RMG sector. These are: cotton, yarn, grey fabric, finished fabric, trims and accessories. The below chart shows what materials the industries need to procure. From the information the study has collected in this survey, The study can see that among them, most of the industries buy trims which is 77.1%.

| Figure 1. Typically bought raw material |

Why & when imported raw materials are chosen over locally produced ones

The study has identified some factors for choosing imported raw materials over locally produced raw materials. These are: as per buyer requirement, due to unavailability, for R&D requirement, for better quality. The below chart shows the factors for choosing imported raw materials. From the information the study has collected from this survey, The study can see that among them, most of the respondents think better quality is the main factor which is 75.7%.

| Figure 2. Lessons for choosing imported raw material |

Considerations when selecting a supplier

The study has identified some considerations when selecting a supplier. These are: previous trade relationship, quality and certifications, less price, buyer’s requirement, reputation and capabilities. The below chart shows the considerations when selecting a supplier. From the information the study has collected from this survey, the study can see that among them, most of the respondents think quality and certifications is the main factor which is 81.4%.

| Figure 3. Considerations of selecting a supplier |

Backward linkage transport modes

The study has identified some backward linkage transport modes. These are: by sea, by air and by land. The below chart shows the backward linkage transport modes. From the information we have collected from this survey, the study can see that among them, most of the use by sea as their transport mode which is 81.4%.

| Figure 4. Backward linkage transport modes |

Study on challenges using SPSS statistics

This project has provided some hypothetical statements that the study thought to be relevant to this study. This project asked the respondents the convey their options about each of the statements. This paper analysed the response of 70 samples and found the percentages of each of the option along with the standard deviation. Standard deviation measures the dispersion of a data set. In this study the standard deviation measures how much deviation from the agree option. From the challenge statement it much it deviated. Each option is represented by using percentage from the number of responses that this study got. The collected data analysis from the linear scales are given below and the scale is used to collect data:

| Statement | Strongly Agree | Agree | Neutral | Disagree | Strongly disagree |

|---|---|---|---|---|---|

| The local material industry is not well established | 54.3% | 35.7% | 8.6% | 0 | 1.4% |

| Cotton production is very low in Bangladesh | 80% | 18.6% | 1.4% | 0 | 0 |

| There are no well-known local brands for trimmings | 21.4% | 54.3% | 17.1% | 7.1% | 0 |

| There are no well-known local accessory brands available | 18.6% | 34.3% | 34.3% | 7.1% | 5.7% |

| Unable to meet sustainability standards in backward linkage industry | 67.1% | 17.1% | 12.9% | 0 | 2.9% |

| Unable to meet eco-friendly standards in backward linkage industry | 61.4% | 27.1% | 7.1% | 1.4% | 2.9% |

| Factory Infrastructure for backward linkage is not well established | 38.6% | 41.4% | 17.1% | 1.4% | 1.4% |

| Government initiatives are insufficient to support expanding local backward-linkage industries | 14.3% | 28.6% | 41.4% | 11.3% | 4.4% |

| Lack of investment for growing local backward linkage industries | 30% | 20% | 24.3% | 21.4% | 4.3% |

| Lack of skilled man power for backward linkage industries | 51.4% | 30% | 11.4% | 5.7% | 1.4% |

| Lack of maintenance of SOP in backward linkage supply chain management | 64.3% | 25.7% | 8.6% | 0 | 1.4% |

| Lack of use of software to monitor the correct material flow | 42.9% | 41.4% | 15.7% | 0 | 0 |

| Lack of proper machineries for backward linkage industries | 34.3% | 54.3% | 10% | 1.4% | 0 |

| Lack of entrepreneurship and innovation in backward linkage industries | 60% | 24.3% | 12.9% | 2.9% | 0 |

Root cause analysis of major challenges

Reasons for less cotton production in Bangladesh The study has identified some reasons for less cotton production in Bangladesh. These are: scarcity of arable land, lower price of cotton for the farmers, lack of research and lack of investment. The below chart shows the reasons for less cotton production in Bangladesh. From the information the study has collected from this survey, The study can see that among them, most of the respondents think lack of research is the main reason which is 79.4%.

| Figure 5. Backward linkage transport modes |

Reasons for less synthetic/man-made material production in Bangladesh The study has identified some reasons for less synthetic/man-made material production in Bangladesh. These are: lack of machines, lack of entrepreneurship and innovation, lack of technology and lack of investment. The below chart shows the reasons for less synthetic/man-made material production in Bangladesh. From the information the study have collected from this survey, The study can see that among them, most of the respondents think lack of research is the main reason which is 82.1%.

| Figure 6. Reasons for less synthetic material production in Bangladesh |

Reasons for less trims production in Bangladesh The study has identified some reasons for less trims production in Bangladesh. These are: poor quality, lack of certification, lack of investment, lack of raw materials. The below chart shows the reasons for less trims production in Bangladesh. From the information the study has collected from this survey, the study can see that among them, most of the respondents think lack of certifications is the main reason which is 83.6%.

| Figure 7. Reasons for less trims production in Bangladesh |

Reasons for less accessories production in Bangladesh The study has identified some reasons for less accessories production in Bangladesh. These are: poor quality, lack of certification, lack of investment, lack of raw materials. The below chart shows the reasons for less accessories production in Bangladesh. From the information we have collected from this survey, the study can see that among them, most of the respondents think lack of certifications is the main reason which is 88.1%.

| Figure 8. Reasons for less accessories production in Bangladesh |

Challenges in terms of fabric procurement

The study has identified some challenges for fabric procurement in Bangladesh. These are: low number of woven industries, increased price of yarn, sourcing price hike, buyers unwilling to pay more. The below chart some challenges for fabric procurement in Bangladesh. From the information the study has collected from this survey, the study can see that among them, most of the respondents think increased price of yarn is the main reason which is 92.5%.

| Figure 9. Challenges for fabric procurement in Bangladesh |

Discussion

The study’s authors uncovered the sector’s backward linkage difficulties and recognized its potential benefits. According to the research presented here, several different types of certifications are important to different types of buyers. Companies like Sunny Cotton, PGS, Tradecom, Zaber spinning, Masco, Ha-Meem, SQ, Square, Bros, Allenberg, Cargil, Noble group, Shonxing, etc. are mentioned in this article as examples of leading domestic and international cotton producers.

In addition, this study identifies a number of leading local and international companies in the trims & accessories industry, including Rpac, Babylon, ABS trims, Blue Planet, COTS, UNION accessories, Montrims, clever narrows, Avery dennison, Checkpoint, Annie aircraft, etc. Cotton, yarn, fabric, trimmings & accessories, dye & chemicals, etc. are all examples of raw materials that can be purchased. As can be seen in Figure 1, 77.1% of businesses in the study area purchase trimmings, 75.7% purchase accessories, 72.9% purchase yarn, and 58.6% purchase cotton. The majority of the sample set of businesses regularly purchase all of the aforementioned supplies.

Figure 4 shows that while transporting goods, businesses rely on three distinct modes: the sea (88.6%), the air (57.1%), and the land (62.9%). There are some who juggle multiple modes of transportation. Using a linear scale collected via Google Form, this study performed SPSS analysis of the hypothetical problem statement. Analysis with SPSS revealed the percentages as shown in Table 2. As the table shows, this is corroborated by the data: “Cotton production is quite low in Bangladesh.” obtained 80% agree, 18.6% strongly agree, and a standard deviation of 0.447. Standard deviation is 0.697, 34.3 percent of respondents strongly agree, 54.3 percent agree, and 34.3% are neutral. 42.9 percent of respondents gave a “strong agree” or “agree” rating, while 41.4 percent gave a “neutral” rating, and the standard deviation was 0.721.

In a poll, 54.3 percent of respondents said they strongly agreed, 35.7 percent said they agreed, and the standard deviation was 0.771 points. 64.3% strongly agree, 25.7% agree, and the standard deviation is 0.775 for the statement “Lack of maintenance of SOP in backward linkage supply chain management.” Using percentages and standard deviations from the SPSS analysis, this study concludes that the aforementioned problems are the most pressing. The study then used the replies, depicted as a bar chart with percentages for each reason from the mentioned figures, to determine the origins of the most pressing problems.

The majority of respondents (79.4%) believe that a lack of research is to blame for Bangladesh’s low cotton output. Figure 6 shows that the majority of respondents (82.9% to be exact) attribute lower synthetic material production in Bangladesh to a dearth of machinery. Figure 7 shows that the majority of respondents (83.6% agree) believe that a shortage of necessary certificates is to blame for Bangladesh’s dwindling output of trims. As can be seen in Figure 8, the majority of responders (88.2%) attribute lower accessory manufacturing in Bangladesh to a deficiency in necessary certificates. The majority of respondents (92.5% according to Figure 9) attribute the difficulty of sourcing fabrics in Bangladesh to the rising cost of yarn.

Findings of different types of challenges

For understanding the findings more accurately the study categorized the challenges according to the value of standard deviation using the below mentioned defining scale. Then categorized under sections such as most vital, moderate viral and least vital. This explains the challenges that should be addressed according to the significance of its impact.

Findings of reasons & limitations behind major challenges

For understanding the findings of reasons & limitations behind the major challenges faced in the backward linkage industries of Bangladesh. These findings portray the industry wise major challenges and their reasons & limitations.

| Industry | Challenges | Reasons & limitations |

|---|---|---|

| Cotton | Low production of cotton in Bangladesh | 1. Scarcity of suitable soil for cotton production 2. Lack of proper genetical engineering research on cotton |

| Trims & Accessories | Low acceptability of trims & accessories | 1. Lack of certification 2. Lack of quality 3. Lack of sustainability & green technology 4. Lack of raw materials |

| Fabric | Price hike of fabric & low production of synthetic fabric | 1. Increased price of yarn 2. Low number of woven industries 3. Lack of specific machineries for synthetic fabric 4. Lack of entrepreneurship on synthetic fiber industry |

| Dyes & Chemicals | No local manufacturer that can provide dyes & chemicals | 1. Not enough incentives from the government. 2. Insufficient investment |

Conclusion

The study examined the potential benefits and drawbacks of backward linking for Bangladesh’s readymade garments sector. Bangladesh is a developing country whose economy relies heavily on the readymade garments industry, but the country is unable to make full use of its manufacturing facilities because of inadequate backward connection. A total of 56 different industries and government agencies contributed to this data set. In this research, we will look at the problems plaguing this industry and place them in a historical context, where we may examine the causes and constraints of those problems.

The data is collected, organized, and evaluated so that a true picture of the state of backward linkage industries can be painted. Most of the information centered on the declining cotton crop, insufficient quality certifications, and outdated machinery and lack of new developments in the synthetic materials sector. The government of Bangladesh ought to give this sector some thought by encouraging innovators and entrepreneurs to create products that can be labelled “Made in Bangladesh” for the sake of the country’s backward linking economy. A crucial issue will be resolved if the country is able to mass-produce genetically modified cotton.

This should work out fine, thanks to government’s decision to contaminate the genetically modified cotton researcher. We have the ability to harness our own potential by launching a new EPZ tailored to backward linkage business, where we can manufacture cotton, trims & accessories, synthetic materials, etc. The health of our export sector will improve if business owners view this as a positive opportunity. In the end, the researchers outlined a plan to help Bangladesh fix its lagging linkages.

The sample size of this research is modest, and its applicability might improve if the authors had access to more data. Anyone doing research on the subject should look for obvious things like fixing the industry’s structural flaws. The few lagging linking issues present a serious barrier due to the lengthy lead time. Particular backward linking industries, such as cotton, trimmings & accessories, synthetic materials, etc., may be the focus of a thorough investigation.

Author:

References

Check out these related articles:

1 thought on “Backward Linkages | RMG Sector in Bangladesh”