Md. Nurun Nabi1*

PhD Fellow, Huazhong University of Science and Technology(HUST), Wuhan, China, and Assistant Professor, Bangladesh University of Textiles

Mst. Marium Akter2

Lecturer, Accounting, Sonargaon University; Bangladesh

Abstract

This study represents the impact of COVID 2019 on the foreign direct investment of the textile and economic sector. Bangladesh is a rapidly economically growing country and proportionately depends on the Foreign Direct Investment (FDI). This pandemic situation not only affects the Ready-made garments but also affects the other economic sectors like agro-processing, pharmaceuticals, and chemicals, ICT and telecommunication sectors, etc. the FDI and GDP are decreasing drastically. Now the largest FDI investor country is switching from the host country to another country. The different countries like India, Japan, Vietnam are searching for alternatives sources of their marketing and production. Bangladesh is also searching for a new area where they may search for new raw materials. The Foreign Direct Investment (FDI)is decreasing due to pandemic across the country. The BIDA and BEPZA Formulate some action plan to fight against the Coronavirus and attract foreign direct investment. Different lucrative and attractive packages were declared by the government of Bangladesh.

Key Words: COVID-19, Foreign Direct Investment (FDI), Ready made garments (RMG), Economic sectors, etc.

Introduction

As Bangladesh is a rapid economic growing country its acceleration largely depends on foreign direct investment (FDI). Foreign direct investment is assumed as the prerequisites of the upcoming economy. Foreign Direct Investment (FDI) is the major driving force for industrialisation, economic diversification, economic growth, and structural transformation of many countries’ development. In this COVID-2019 pandemic, especially in Bangladesh, the foreign direct investment (FDI) is decreasing and the consequences are huge and economic loss is more.

The pandemic situations devastate people’s life and wealth, societies, and the nation’s economy. It affects, especially in domestic productivity and employment. It faces the loss of foreign income in the RMG and International Remittances sectors. Foreign Direct Investment is considered a potential weapon of achieving the desired goal in the socio-economic development of Bangladesh. FDI creates the opportunity to create employment, develop productivity capacity, build a physical structure, transfer knowledge through integration of know-how and knowledge (Hossain, n.d.). It helps the technology transfer from the home country to the host country. This pandemic situation disrupted the normal flow of foreign direct investment and hampers the global economy as well as the domestic economy. Globally there are almost 40% of the reduction of worldwide economic growth (Gopalakrishnan, Peters, & Vanzetti, 2020).

The pandemic situations devastate people’s life and wealth, societies, and the nation’s economy. It affects, especially in domestic productivity and employment. It faces the loss of foreign income in the RMG and International Remittances sectors. Foreign Direct Investment is considered a potential weapon of achieving the desired goal in the socio-economic development of Bangladesh. FDI creates the opportunity to create employment, develop productivity capacity, build a physical structure, transfer knowledge through integration of know-how and knowledge (Hossain, n.d.). It helps the technology transfer from the home country to the host country. This pandemic situation disrupted the normal flow of foreign direct investment and hampers the global economy as well as the domestic economy. Globally there are almost 40% of the reduction of worldwide economic growth (Gopalakrishnan, Peters, & Vanzetti, 2020).

Present Scenario of FDI

In some developing countries, FDI stimulates economic growth and development by injecting foreign money and capital, removing the complexity of balance of payments, increasing employment and creating new job opportunities, the spread of new technology management systems, and expanding the market opportunity. During fiscal year (FY) 2019, FDI in Bangladesh increased by 51%, to US$3.9 billion — a record high. FDI, as well as GDP, increased from 0.92% to 1.28% over the year. During the last January to July, the FDI inflow increases the $1.69 and 4% higher than the previous year.

|

| Figure 2: Proportional Distribution of FDI |

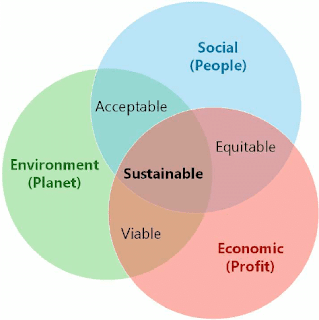

A financial report expressed by the Bangladesh Bank (BB), China was the largest FDI sender country during FY 2019, net FDI inflow of $1.16 billion, followed by the Netherlands ($802.8 million). The increasing rate of GDP is almost 8.15% and the World Bank (WB) and Bangladesh Bureau of Statistics (BBS) estimated the proliferation of rate of GDP is almost 7.2% to 8.2% in the fiscal year of 2020. Foreign Direct Investment urges the need for sustainable economic growth, encourages domestic investment, prefers economic and technological factors for sustainable growth of international production, technology transfer, and market penetration for the new original of industrialisation (Sarker & Khan, 2020).

The emergency of coronavirus devastates the emerging economic growth like Bangladesh. The Asian development bank forecasted the loss of GDP is $3 billion or 1.1%. The World Bank shows another accounting the initial forecasting GDP will increase by 2 to 3 percent in 2020 and but due to the pandemic was dropped by 4.2% to 5.2%.

Table -01: The overall position of foreign direct investment (FDI) inflows in Bangladesh

Discussion

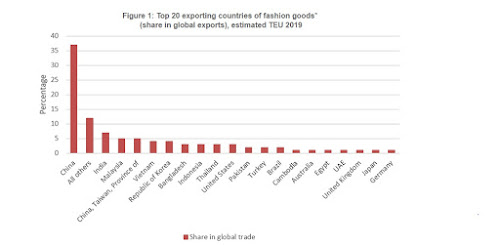

Every sector was affected by the corona pandemic. Now let’s talk about the most influential ready-made garments and the impact and hit of the coronavirus is huge in this area. The loss is immeasurable and uncountable as well as unpredictable. The buyers and suppliers are cancelling the order and the total amount is almost $3 billion and the knitwear producer and manufacturer are also facing a similar loss. RMG and knitwear manufacturer constitute losses about 18 % of the total revenue of ready-made garments, which accounts for 84 % of the foreign earnings. Due to the pandemic, the international remittances have been declined drastically because of closures of the factory and construction area. The workers are migrating particularly in the Middle East and Europe. The international remittances are dropped in march 2020 by $172 million or 11.8% loss compared to 2019.

Many remarkable countries are investing in our country. The dominant country in Western Europe, the United States, Japan, China, and many other countries. The dominant countries are mostly affected by the coronavirus and China has recently emerged as the leader in FDI in Bangladesh, replacing the United States (US) and United Kingdom(UK). Other leading East Asian countries having also remarkable investments in Bangladesh are Japan and Singapore.

Germany and Norway foreign direct investment (FDI) inflows of about $135 million in Bangladesh, which is much lower than that by leading investors. Some countries like Japan have already decided to move production plants from China. The garments industry might be the future place of foreign direct investment (FDI). If the BGMEA and BKMEA work together to retain and sustain the foreign direct investment (FDI) like japan. The new window is going to open and government assertive and imperative affords may lead to attracting the japan. With an adequate campaign and the right incentives, Bangladesh can make itself an attractive place for the countries currently investing in China to redirect their investments. Now China is searching for a new area because of the trade war between China and the US. Trading is getting lower between the USA and China dropped by about $60 billion in 2019.

RMG buyers that order from China may consider other countries for their investments, such as Bangladesh. The buyers and suppliers are shifting from China to other deplorable areas. Bangladesh can take the opportunity of this pandemic situation. It has huge manpower as well as location facilities. Bangladesh’s existing manufacturing facilities and skilled, semi-skilled, unskilled employees are a comparative advantage in this regard. “Globalisation and the Climate of Foreign Direct Investment: A Case for Bangladesh” is emphasised that FDI is drastically related to the globalisation and industrialisation process where it influences the countries’ economic growth and economic development (Saha, 2012).

Sectorial FDI distribution

|

| Figure 3: Sector-wise FDI distribution |

In other economic sectors like health care and health, care management is very few in foreign direct investment (FDI) like $ 2 billion. Pharmaceuticals and chemicals is a remarkable sector for foreign direct investment (FDI). according to the International Monetary Fund report, there is 267 pharmaceutical and chemicals factory. Among them, there are very few like 10 multinationals foreign companies. The previous year’s contribution was mostly notable $46.8 million and which is 1.3% per cent of total FDI. $ 2.6 billions were a foreign direct investment (FDI). The Bangladeshi most pharmaceutical and chimerical company largely depends and sourcing of raw material comes from China and India.

Foreign direct investment (FDI) goes almost $500 million. The net foreign investment in ICT was $246 million in 2019 ($219.9 million in telecommunication and $26.1 million in software and IT); therefore, there is potential for further expansion. Besides, agro-processing has significant foreign investment potential. Agro-food processing contributes to 1.7% of GDP and 1.5 % of food exports, amounting to $400 million. There is already a demand for Bangladeshi food items by Bangladeshi diasporas in Europe, North America, and the Middle East, and companies such as Pran, Square, ACI, and Akij Foods satisfy such needs. Besides, with a growing economy and urbanization in Bangladesh, the middle class is expected to grow, and so is the local demand for processed food. The bio-lateral and multilateral trade agreement will help to flourish our agro-processing garments industry. Foreign Direct Investment helps the host country for technology transfer, better business operations, and creating for new job opportunities (Mondal, 2003).

The government has already taken measures to attract. There is already a demand for Bangladeshi food items by Bangladeshi diasporas in Europe, North America, and the Middle East, and companies such as Pran, Square, ACI, and Akij Foods satisfy such needs. Besides, with a growing economy and urbanisation in Bangladesh, the middle class is expected to grow, and so is the local demand for processed food. Foreign Direct Investment has a casual relationship between economic growth and GDP. FDI is going to generate the employment opportunity, increase domestic competition, and transfer of technological opportunities. The Bangladesh government is offering attractive investment opportunities to attract foreign direct investment (Khatun & Ahamad, 2015).

The government has already taken measures to attract foreign investment in this sector, including the allocation of a dedicated agro-processing zone, tax holidays, and cash incentives for agro-processors.

In this sector, including allocation of a dedicated agro-processing zone, tax holidays, and cash incentives for agro-processors.

Recommendations

👉Action plan and mobilise activities to attract Foreign Direct Investment (FDI):

The government of Bangladesh is going to take some measurable steps to mobilise foreign direct investment (FDI) for the countries’ sustainable development. As the global economy is shrinking and dropped by 40% and weakens the foreign direct investment (FDI) by a coronavirus. The steps will help more to flourish all potential sectors including textiles to other economic indicators.

➥Bangladesh Investment Development Authority (BIDA) encourages and inspires the foreign direct investors and prepares a plan for one-stop service.

➥Preparing a database of 41 countries relating to the FDI.

➥Bangladesh Economic Zones Authority (BEZA) has offered an incentive package to attract foreign investors after coronavirus is over, which includes a VAT waiver on land leasing, bonded warehouse facility for local companies, 100 % waiver on corporate tax for 10 years, and more.

➥BEZA has already received FDI proposals worth $5.8 billion, which is a good indication that the incentive package is attracting investment.

➥The government is going to encourage foreign direct investors to set the industry in the private sector.

➥The government is encouraging the Public-Private Partnership (PPP) for the attraction of the FDI.

➥Indirect investment through the joint venture of the other similar company.

➥Tariff free access to the European union

➥Introduced a new Entrepreneurship Equipment Fund

➥Deduction of corporate tax for 10 years for all foreign investors and export-oriented manufacturers as well as VAT waiver on land leasing and bonded warehouse facility for all local and foreign investors.

➥It is going to propose that the company that invests the $100 million and employee 300 workers will receive the special tax benefits from the government.

➥BEZA officials said they also recommended reducing corporate tax to 25 from the existing 35 per cent for local investors since the current rate of tax in India is 22 per cent and 20 per cent in Vietnam and Thailand.

➥BGMEA and BKMEA are extending hands with different incentive packages for attracting foreign direct investment.

Conclusion

In sum, the coronavirus is hitting all over the country and now many countries are searching for a new opportunity of trading and business. Foreign Direct Investment is now a hot cake. In these circumstances, the competition is global or worldwide not limited to a single country. The investee country is more than the investor country. If Bangladesh can come up with the different opportunities and packages the foreign direct investors will come to our land. A proper work plan and timely action will help Bangladesh to make itself a more attractive and blooming place for international investment.

References

- Gopalakrishnan, B., Peters, R., & Vanzetti, D. (2020). Covid-19 and Tourism. (July), 1–27.

- Hossain, M. A. (n.d.). Impact of Foreign Direct Investment on Bangladesh’s Balance of Payments : Some Policy Implications. Statistics, 1–9.

- Khatun, F., & Ahamad, M. (2015). Foreign direct investment in the energy and power sector in Bangladesh: Implications for economic growth. Renewable and Sustainable Energy Reviews, 52, 1369–1377. https://doi.org/10.1016/j.rser.2015.08.017

- Mondal, W. I. (2003). Foreign Direct Investment In Bangladesh: An Analysis of Perceptions of Prospective Investors. Studies in Economics and Finance, 21(1), 105–115. https://doi.org/10.1108/eb028771

- Saha, D. A. K. (2012). The scenario of the Foreign Direct Investment (FDI) in Bangladesh: An Evaluation. IOSR Journal of Business and Management, 5(6), 19–26. https://doi.org/10.9790/487x-0561926

- Sarker, B., & Khan, F. (2020). Nexus between foreign direct investment and economic growth in Bangladesh: an augmented autoregressive distributed lag bounds testing approach. Financial Innovation, 6(1). https://doi.org/10.1186/s40854-019-0164-y

Texpedi.com