Letter of credit, also known as a credit letter (LC), is an assurance from the foreign bank that a buyer will make the right payment to a seller on time and in full. In the world of international trade, letters of credit are often employed to make a safe and reliable transaction. There are various kinds of LCs in effect. Here in this paper, we outline the “whats” and “hows” of letters of credit and illustrate the many kinds of letters of credit.

Introduction

A letter of credit (LC) is a document entitling the legal commitment issued by the bank of the foreign buyer to assure that the payment in full will be made after the exporter had shipped the goods and presented the required evidence of shipment. [1] [2] Letters of credit are a trade financing measure used to safeguard both transaction parties – exporter and importer. In other words, the exporter receives a payment assurance while giving the importer fair payment conditions. They also assist in acquiring new clientele in international marketplaces. [2]

History of Letter of Credit

Letter of credit, also known as documentary credit has emerged in Europe since ancient times for international trading. When two parties trading does not know themselves personally, separated by time-borders-laws, a LC is a go-to payment method. In the 19th and 20th centuries, travelers commonly used commercial letters of credit which were issued by a relationship bank. Mainly they carried LC to withdraw cash from other banks according to their needs around the globe.

The mechanism is traditionally controlled by international rules and regulations, not by national laws, which were non-uniform and had limited functionality until 1933. When the international chamber of Commerce (ICC) came up with a framework and proposed its very first uniform customs and practice for UCP (Uniform Customs and Practice for Documentary Credits), the letter of credit flourished in its functionality. The UCP is an aggregation of a set of written rules and practices to assure uniformity, understanding, and application of LC. Since its first version “UCP 82”, it has been revised several times until its latest version “UCP 600” reformed in 2007.

How a Letter of Credit Works

A LC is generally required by buyers of large quantities of items to guarantee that the payment will be completed. In effect, the bank assumes responsibility for the seller’s payment by issuing a letter of credit as a guarantee. Before the bank guarantees the payment to the seller, a buyer must demonstrate to the bank that they have adequate assets or a sufficient line of credit to pay. For issuing an LC, banks normally need a commitment of securities or cash as collateral. The beneficiary or any other bank the beneficiary designates gets paid by the issuing bank since a letter of credit is normally a negotiable instrument. [1] [2]

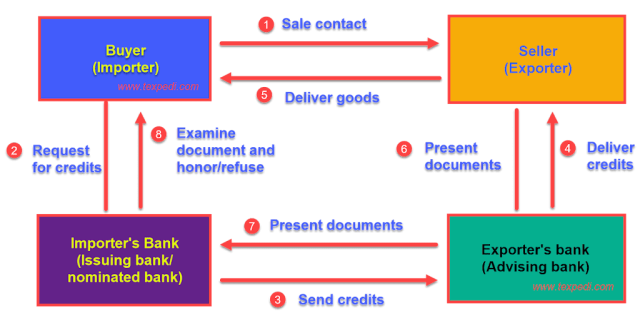

How does a letter of credit work?

|

| Figure 1. Process flow of LC. [3] |

Types of Letters of Credit

Several categories of letters of credit exist. Some of the standard letters of credit are:

- Commercial LC

- Confirmed LC

- Revocable LC

- Restricted LC

- Transferable LC

Following are the variations of the standard LC: [4]

- Standby LC

- Back-to-back LC

- Revolving LC

- Deferred LC

- Red clause LC

Commercial Letter of Credit

This is a widely used letter of credit. It is also referred to as the import/export LC. This is why, for the importer, it is called an Import LC and for the exporter, an Export LC. [5]

Standby Letter of Credit

This type of letter of credit is provided if something crucial fails to happen. Instead of enabling a transaction, this type of letter of credit is used to ensure compensation for the failure. [6]

Back-to-Back Letters of Credit

To link buyers and sellers, intermediaries might use back-to-back letters of credit. A “master” LC may be used by the supplier and the intermediary, and the ultimate buyer and intermediary may use a letter of credit that is based on the master letter. [7]

Revolving Letters of Credit

When a buyer and seller operate under an arrangement where goods are shipped continuously over a specified period, it may be desirable to establish a revolving LC to handle the shipments as they occur, rather than individual LC for individual shipments. [4]

Deferred Payment LC

Payment under this kind of letter of credit is delayed once the documents are approved. Before the vendor receives money, some predetermined period is passed. A deferred payment LC is naturally a better deal for buyers than for sellers, as it allows the buyer time to find fault with something the seller does. [7]

Red Clause Letter of Credit

Before dispatching the goods, the seller can withdraw the pre-paid portion of the money from the bank. The first portion of the credit is to get the attention of the accepting bank. The assigner bank establishes the credit for the first time to attract the attention of the offered bank. The terms and conditions were generally printed in red ink, from where the name Red Clause LC. [8] Apart from these, there are a few other types of LC as well depending on the customized requirements.

Conclusion

The letter of credit is an integral part of international trading. This keeps the transaction of goods and money trusted across our national borders. The different types of LCs are there to fit in special situations as they occur. LC is an essential document for the RMG sector of Bangladesh which is mostly reliant on the export business. Without the trust and legal safety of LC, it is impossible to ensure on-time and full payment. Thus, LC plays an ever-so-important role in our Textile and RMG sector.

References

[1] J. Kagan, “Letter of Credit: What It Is, Examples, and How One Is Used,” 2021. [Online]. Available: https://www.investopedia.com/terms/l/letterofcredit.asp.

[2] “International Trade Administration,” [Online]. Available: https://www.trade.gov/letter-credit.

[3] “Letters of Credit,” Trade Finance Global, 2022. [Online]. Available: https://www.tradefinanceglobal.com/letters-of-credit/.

[4] I. Weissman, “Letter of credit – Doing business in a global market,” The CPA Journal, vol. 66, no. 1, p. 46, 1996.

[5] W. E. McCurdy, “Commercial Letters of Credit,” Harvard Law Review, vol. 35, no. 5, p. 54, 1922.

[6] J. Pritchard, “Different Types of Letters of Credit,” the balance, 2021. [Online]. Available: https://www.thebalancemoney.com/types-of-letters-of-credit-315040.

[7] Scotiabank, “Documentary Letters of Credit: A Practical Guide,” [Online]. Available: https://instruction2.mtsac.edu/rjagodka/Importing_Information/Letter_Of_Credit_Guide.pdf.

[8] Bhogal T., International Trade Finance: A Pragmatic Approach, ISBN 978-0230594326, 2007.

Abir Hassan Limon, Suvendu Karmokar Emon, Md. Sohanur Rahman, Abir Mohammad Said and Oyshe Sikder

B.Sc. in Textile Engineering

Department of Textile Engineering Management (44th Batch)

Bangladesh University of Textiles

Texpedi.com

Check out these related articles: